By John Sykes

While I don’t agree with almost anything Joseph Stiglitz says, Stiglitz’s Switch in Time reports that:

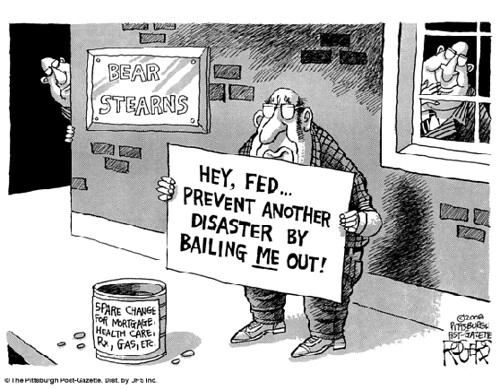

Speaking before a group of protesters in Zuccotti Park, Nobel economics prize winner Joseph Stiglitz urged on the crowd, telling them they are “right to be indignant.” Professor Stiglitz goes on to explain, correctly in my view, that we have a financial system of socialized losses and privatized gains.

Stiglitz is right for once and sooner or later we are going to have to realize that our tax code has been designed to help a lot of lawyers and accountants protect losers like me by transferring those losses to We the People and reducing tax revenues in the process. I’m no “fat-cat” but I have used capital loss provisions in the past. In retrospect, I can’t think of any valid reasons why You the People should bear my losses.

As much as the progressives would squawk no, the biggest such recent indignations have been the Obama administration’s massive bail-outs of the banks, the car companies, and, more recently, the green energy companies.

In Privatizing profits and socializing losses Wikipedia adds Fannie Mae and Freddie Mac to this misadventure:

In particular, government sponsoring and bailouts such as the federal takeover of Fannie Mae and Freddie Mac and the proposed bailout of the U.S. financial system in the economic crisis of 2008 have frequently been referred to in the U.S. as “private gains and public losses” or “privatization of profits and socialization of losses”.

And this has gone on for a long time. From —Andrew Jackson, 1834, on closing the Second Bank of the United States:

I have had men watching you for a long time and I am convinced that you have used the funds of the bank to speculate in the breadstuffs of the country. When you won, you divided the profits amongst you, and when you lost, you charged it to the Bank. ... You are a den of vipers and thieves.

So what’s the answer?

Simplify the tax code. A flat tax would probably do it best!

No comments:

Post a Comment